As the government deliberates the idea of implementing taxes on e-cigarettes, various implications come to light, affecting consumers, manufacturers, and the economy. E-cigarettes have become increasingly popular over the past few years, yet their regulation remains a complex issue. The government’s consideration of taxing e-cigarettes raises numerous questions regarding its impact on public health, industry innovation, and consumer behavior. E-cigarette taxation could potentially deter new users, particularly among young people, lowering the appeal of vaping as a trendy habit.

When analyzed from a public health perspective, taxing e-cigarettes could play a pivotal role in controlling the number of users, especially among minors. By making e-cigarettes less financially accessible, it might contribute to fewer instances of nicotine addiction among teens and potentially reduce the future burden on the healthcare system. However, there are concerns that excessively high taxes could inadvertently drive consumers back to traditional tobacco products, undermining the progress made in combating tobacco use.

Economic Considerations

From an economic standpoint, the taxation of e-cigarettes could generate significant revenue for the government. This new stream of income might be directed towards public health initiatives or used to offset healthcare expenditures related to smoking-related illnesses. Moreover, this taxation could influence the vaping industry, prompting manufacturers to innovate and create more appealing, possibly healthier alternatives to avoid losing their customer base.

The key to successful e-cigarette taxation lies in finding a balance that discourages excessive usage without driving consumers back to more harmful smoking habits.

Policy makers must delicately balance these factors when deciding on the best approach to take.

Consumer Behavior Shifts

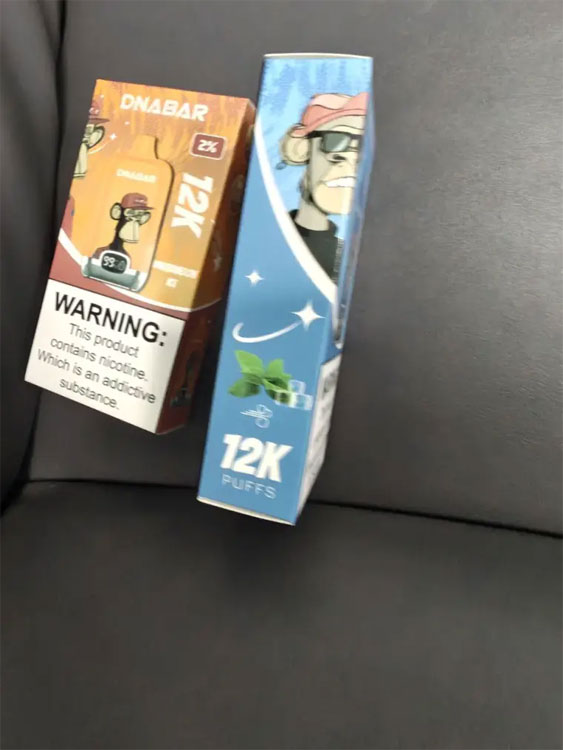

Considering the potential taxation, another critical aspect is the shift in consumer behavior. If e-cigarettes become subject to high taxes, we might see a decline in their popularity among budget-conscious users. This shift could catalyze advancements in product safety and quality, as manufacturers compete to retain their clientele despite the financial deterrents. There lies a possibility that a niche market for premium vaping products could emerge, catering to those willing to pay more for improved features and flavors. On the other hand, the underground market for untaxed e-cigarette products may expand, creating new enforcement challenges for authorities.

become subject to high taxes, we might see a decline in their popularity among budget-conscious users. This shift could catalyze advancements in product safety and quality, as manufacturers compete to retain their clientele despite the financial deterrents. There lies a possibility that a niche market for premium vaping products could emerge, catering to those willing to pay more for improved features and flavors. On the other hand, the underground market for untaxed e-cigarette products may expand, creating new enforcement challenges for authorities.

- Will e-cigarette taxation decrease youth vaping rates effectively?

- Can tobacco product consumption rise due to high e-cigarette taxes?

- How might the e-cigarette industry adapt to maintain profitability?

These frequently asked questions highlight the complexity of e-cigarette taxation, which presents both challenges and opportunities. Finding an effective tax threshold may prove essential in shaping the future landscape of vaping. Strategies must be holistic, considering the multifaceted impacts on health, economy, and society. With careful planning and considerations, the government aims to foster a healthier public, boost economic growth, and maintain industry innovations without compromising public interests. Looking ahead, continual monitoring and adjustment of e-cigarette tax policies will be necessary to ensure they achieve their intended outcomes without unforeseen adverse effects. Stakeholders, including health experts, economists, and industry leaders, should collaborate to devise insights and strategies for optimal results.